Lower Global Oil Prices Make OSV Fortunes Flounder

As oil prices continue to languish and the strain reverberates through the entire energy industry, the offshore supply vessel (OSV) subsector faces another year of rough sailing. Offshore supply ships, which support offshore drilling platforms and offer everything from resupply functions to rescue services, form a maritime industry subsector that generated more than $25 billion in annual revenues at its peak. But as exploration and production companies drastically reduced rig counts, the fortunes of the OSV industry plunged.

Excess capacity affects the many different types of vessels in the OSV market, but the most-serious challenges are found among platform supply vessels and anchor-handling-tug supply vessels—two major market segments whose operators must respond to radically altered economic conditions.1

Shipping companies continue issuing press releases announcing layoffs, the stacking of vessels, and delays in new ship construction. The AlixPartners 2015 Offshore Supply Vessel Study of 33 major companies in the OSV sector pinpoints rising debt burdens, which are making it increasingly unlikely that most of the companies can maintain positive balance sheets because servicing costs consume a greater and greater share of declining earnings. Simply put, demand has declined, and the industry faces intense financial pressure.

Oil prices dropped from more than $100 a barrel in January 2014 to less than $30 a barrel in January 20162, and exploration and production (E&P) companies are continuing to slash growth plans for offshore rig counts.

At the same time, there has been decreased demand for service vessels and crews, thereby, again, slashing growth plans and reducing revenues as vessel usage and day rates get squeezed. According to Clarksons Research, OSV day rates are down about 40% from early 2014.

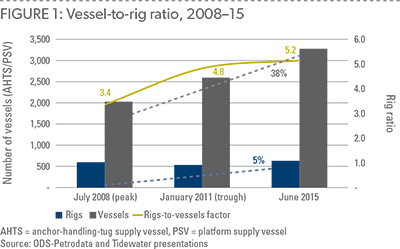

Dwindling rig counts serve as a negative bellwether for the increasingly beleaguered OSV market, a trend unlikely to reverse itself because oil prices remain low. In turn, fewer active rigs mean fewer anchor-handling-tug supply vessels in service. The sharp drop in the growth of rig installations also crimped demand for platform supply vessels. Additionally, constant production at active Chinese shipyards and an easy credit environment for operators helped drive up global vessel counts. According to ship broker RS Platou, OSV global fleet growth in 2015 and 2016 will be almost 18%. That’s an increase of 35% in the vessel-to-rig-count ratio since the January 2008 rig count peak (figure 1).

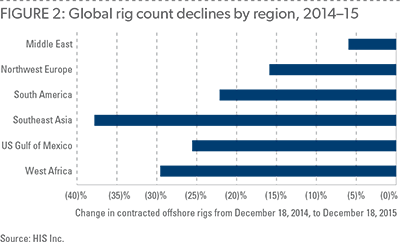

The mismatch in growth rates is explained like this: as of June 30, 2015, OSV inventory increased 38% from January 2008 to June 2015, whereas rig counts increased only 5%.3 Moreover, as of December 2015, rig usage is down 20% worldwide from the prior year across all six major global regions4 (figure 2).

Global and national E&P companies made major cuts in 2015, which drove down oil companies’ average offshore project costs by about 15%.5 Those cuts also resulted in an industry push for reductions in service costs and vessel day rates. There is an emerging preference for onshore projects, which are cheaper than the offshore plays, and that lower demand is compounded by high fleet growth rates, which serve to shrink margins and contract prices.

|

|

Regional review: Brazil, Middle East, and Southeast Asia

Brazil, formerly a key market for stable, long-term OSV charters, continues to reel from a corruption scandal that rocked state oil producer Petrobras. The impact of the scandal together with low oil prices on the OSV market has been significant because several charter contracts have been canceled or renegotiated as Petrobras scales back capital expenditures.

In addition, Brazilian-flagged vessels have been asserting their rights to challenge the existing charters of non-Brazilian-flagged vessels, which has placed the owners of the latter in difficult financial and legal positions.

The OSV market in Southeast Asia remains weak, with low utilization levels and low rates caused by decreased demand and amplified by a significant oversupply of vessels. Malaysia and Indonesia are key drivers for the regional market, and cabotage rules are in place, which prioritize domestic-flagged vessels. Vessel owners, including local ones, are competing for utilization. Some owners have responded to the regional slump by deploying their vessels to the Middle East and other parts of the world where demand is stronger and rates are higher. The oversupply issue could be mitigated by scrapping or selling off older, less-economic vessels. However, those vessels are smaller than the tonnages preferred by the commercial ship-broking industry, and the low scrap values of OSVs give owners only limited incentives to pare their fleets.

In contrast, the Middle East market remains relatively robust, because OPEC’s decision to sustain production levels and protect market share despite falling oil prices keeps the OSV industry in business there. The market is relatively open to foreign players, but there are strict registration and qualification requirements that owners must meet before they can compete for contracts. Saudi Aramco and the Abu Dhabi National Oil Company remain committed to ambitious, five-year capital expenditure plans to raise production capacity.6 The OSV market continues to benefit, with reports of tendering activity. However, because the market is highly competitive and because owners from other regions, particularly Southeast Asia, have been mobilizing vessels into the area, rates would likely be fixed at a discount from prevailing levels.

How OSV fleets can navigate choppy waters

The AlixPartners 2015 Offshore Supply Vessel Study found that the 33 companies studied—which averaged $445 million in revenue in the 12 months through June 2015—now have an overall debt load that is up 16% from 2011’s peak, totaling $22 billion. The $3-billion increase over four years will play a major role in determining which companies survive the downturn, which falter, and which get absorbed by competitors with stronger balance sheets.

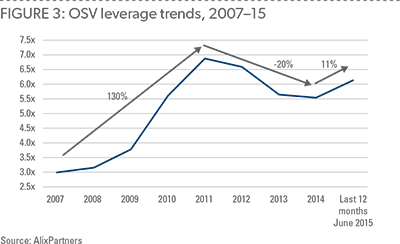

Very low global interest rates played a role in the 130% increase in levels of debt to earnings before interest, taxes, depreciation, and amortization (EBITDA)—also known as leverage—that occurred from 2007 to 2011, the period in which the vessel-to- rig ratio went from a trough to a peak.

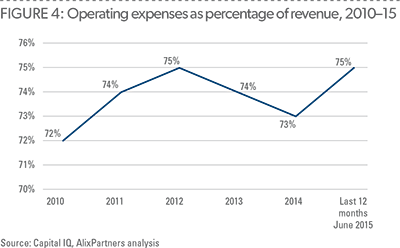

Rising oil prices pushed up earnings, blunting some of that financial effect; but since 2011, leverage increased again, rising 11% in the 12 months prior to June 2015 and putting it at 6.2x (figure 3). The combination of shrinking revenues and lower EBITDA levels means that many OSV companies will likely find themselves struggling to make interest and amortization payments. In addition, an AlixPartners Altman Z-score analysis of those companies showed that 17 had scores less than 1.8 at the end of 2014, indicating a high probability they could be headed toward bankruptcy if they do not take significant financial measures.7 That means OSV operators must trim operating expenses wherever possible. Operating expenses have, however, risen as a percentage of revenue, growing from 72% in 2010 to 75% in the 12 months ended June 2015 (figure 4). In the face of declining revenues and shrinking balance sheets, companies will have to become more aggressive about cutting operating expenses as they move on.

|

|

To navigate the current environment, OSV operators should continue to:

-

Review and stress test current liquidity assumptions and forecasts. Companies must develop a firm understanding of liquidity runway, identify and manage key risks, and seize opportunities to extend themselves through what could be a prolonged market downturn.

-

Reduce overhead costs so as to align with market realities.

-

Maximize fleet utilization. With day rates dropping, the locking in of contracts for longer time periods could help stabilize OSV companies’ top lines and provide some predictability for the E&P companies that are also trying to stabilize their own costs. As long as marginal costs get covered, remaining cash flows can be used to service and reduce debt. A rigorous process should be implemented for each charter to see whether it can contribute in this way or to determine whether the vessel should be stacked or sold.

-

Reduce capital expenditures in similar fashion to oil companies that have taken the scalpel—and sometimes the ax—to their capital spending. OSV operators should do the same. Each company must identify and rank its own projects and cut out all spending that will not generate sufficient cash-on-cash returns.

-

Negotiate better rates from their own service providers.

-

Uncover slack and inefficiencies in their supply chains and reduce those costs.

A couple of positive trends may also factor into the OSV industry’s response. Diesel fuel is now cheaper, and fuel hedges can effectively lock in lower costs for vessels still operating. In a somewhat volatile price environment, any upswing could help sustain ongoing deepwater E&P projects that are otherwise costly to terminate. This would be most helpful to OSV vessels with the best technology, generating a better outlook for companies with the most-modern fleets.

Low oil prices are unlikely to last forever; many experts say they see a positive environment for oil prices in the longer term. The OSV success stories of the immediate and longer-term futures will be about companies that took aggressive measures to survive today’s rough seas. The reshaped industry will likely be one in which fleet operators continue developing and nurturing long-term relationships with blue-chip customers while they standardize vessel designs for greater efficiency when feasible.

Charting that course toward a less stormy market will not be easy, but OSV management teams should look to all of these beacons as helpful guides during the current, difficult stage in the energy industry cycle.

1 Multipurpose service vessels, crew vessels, standby vessels, rescue vessels, and other kinds of vessels make up the rest. The market is further segmented on the basis of geographies: North America, South America, Asia Pacific, Europe, West and South Africa, Middle East, and the rest of the world.

2 Nicole Friedman, “Brent Oil Briefly Drops Below $30 a Barrel,” Wall Street Journal, January 13, 2016,

http://www.wsj.com/articles/crude-prices-pushed-up-from-12-year-lows-by-bargain-hunters-1452680123.

3 ODS-Petrodata and Tidewater presentation.

4 HS Petrodata Offshore Rig Day Rate Trends,” last modified December 15, https://www.ihs.com/products/oil-gas-drilling-rigs-offshore-day-rates.html.

5 “Moody’s Downgrades Seismic Players”, Subsea World News, June 18, 2015, http://subseaworldnews.com/2015/06/18/moodys-downgrades-seismic-players/.

6 Javier Blas and Anthony DiPaola, “There’s One Part of the World Where the Oil Industry Is Booming,” Bloomberg News, May 6, 2015, http://www.bloomberg.com/news/ articles/2015-05-06/there-s-one-part-of-the-world-where-the-oil-industry-is-booming.

7 For which Altman Z-score-analysis-related data is available—for 24 of the 33 companies.